Auto loans guideBest auto loans forever and lousy creditBest car loans refinance loansBest lease buyout loans

So how do we earn money? Our partners compensate us. This might impact which products we evaluate and produce about (and where by People merchandise seem on the website), but it surely under no circumstances impacts our recommendations or guidance, which can be grounded in A large number of hours of study.

Documentation: If you apply, expect to supply copies of pay stubs or tax returns to validate your cash flow. You’ll also have to have to supply evidence of ID and address, between other paperwork, to have authorized.

A 401(k) loan permits you to borrow money from your retirement fund, and — not like a 401(k) withdrawal — you don’t really need to pay back taxes and penalties on a loan provided that you persist with the repayment phrases.

Best IRA accountsBest on-line brokers for tradingBest on the internet brokers for beginnersBest robo-advisorsBest alternatives investing brokers and platformsBest buying and selling platforms for day investing

If you are strike with surprising fees, an unexpected emergency loan will make all the primary difference. Not every personal loan has funding offered the identical or up coming business day for fast cash, but some lenders supply this feature.

NerdWallet suggests trying to go not more than sixty months, if possible. For a longer period phrases will reduce your monthly payment, however , you pays a great deal more in interest Total.

Lenders will perform a tough credit score pull any time here you post your software. Hard credit rating pulls will have an effect with your credit rating. Lowest fee marketed isn't obtainable for all loan sizes, sorts, or uses, and assumes an incredibly well capable borrower with an outstanding credit profile.

NerdWallet strives to keep its facts correct and up-to-date. This info could possibly be diverse than That which you see any time you pay a visit to a monetary establishment, company provider or certain products's web page. All economical items, buying services are presented without the need of warranty.

Less expensive than overdraft fees: By securing a loan, you may stay away from high-priced overdraft charges that would result in the event you didn’t possess the resources at your disposal. Drawbacks

Typically, there are two main funding possibilities available With regards to auto loans: immediate lending or dealership financing. The previous comes in the form of a normal loan originating from a bank, credit history union, or economic institution. The moment a deal has actually been entered by using a vehicle vendor to get a auto, the loan is used from your immediate lender to purchase the new auto.

Test your credit score prior to deciding to use. Know your credit rating so you can Examine for those who qualify depending on each lender's minimal credit rating necessities.

Vehicle loan refinancing calculator. If you already have an car loan, find out if you could lower your expenses by comparing your recent loan which has a new 1.

Still, you should study and browse evaluations from previous and latest clients to establish opportunity safety risks (if applicable). Also, look at the risks dollars-borrowing apps could pose to your economic overall health. Assess your fiscal circumstance and make adjustments to guarantee relying on money-borrowing applications doesn’t become a repeated prevalence.

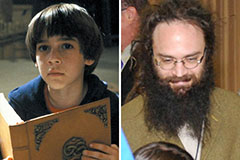

Edward Furlong Then & Now!

Edward Furlong Then & Now! Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now!